All Categories

Featured

Spending in tax liens through purchases at a tax obligation lien sale is simply that-an investment. All Tax Sales in Colorado are conducted per CRS 39-11-101 thru 39-12-113 Adhering to the tax lien sale, successful bidders will certainly get a copy of the tax obligation lien certification of acquisition for each property. Investing in tax liens via acquisition at the tax obligation lien sale is simply that, a financial investment.

Tax Lien Investing Florida

The rates of interest is 15%. Passion is accrued regular monthly and is paid at the time the certification is redeemed. The certification holder can obtain an act three years after the day of sale if the proprietor has not redeemed the certification. No telephone, fax, or mail quotes are accepted. Area certificates can be appointed to people for a$4.00 task fee. The Area held certifications are published in our office and the area bulletin board in the Court house. We likewise publish it on our internet site. Registration will be open for the purchasers the day of sale up until sale time. Our office maintains the initial Tax Lien Sale Certificates on data. This is a benefit to the capitalists for.

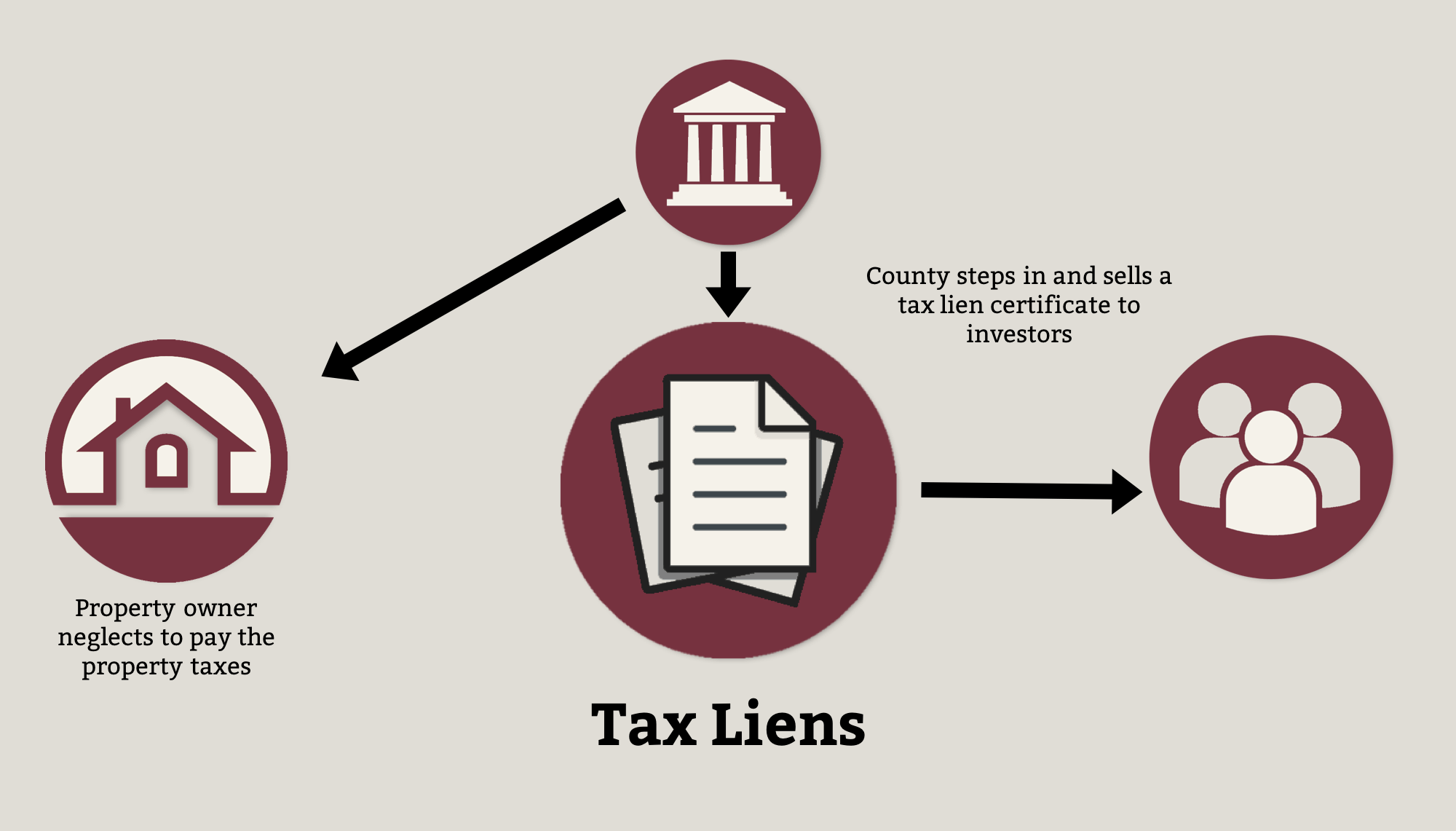

several reasons. When it comes to redemptions, it accelerates getting your refund to you. At endorsement time in August, all you have to do is send in your check along with the appropriate paperwork. When a home owner falls back in paying real estate tax, the area or municipality may place tax lien versus the residential or commercial property. This guarantees that the home can not be.

refinanced or marketed up until the taxes are paid. Rather than awaiting settlement of tax obligations, governments in some cases decide to offer tax obligation lien certificates to personal capitalists. As the proprietor of a tax obligation lien certification, you will certainly receive the passion settlements and late fees paid by the home owner. what is tax lien real estate investing. If the house owner doesn't paythe taxes and charges due, you have the legal right to seize on and take title of the property within a certain time period (normally 2 years) (how to invest in tax lien certificates). Your income from a tax lien financial investment will certainly come from one of 2 resources: Either passion payments and late costs paid by house owners, or repossession on the building sometimes for as little as pennies on the buck.

Latest Posts

List Of Tax Foreclosures

Tax Liens Houses For Sale

Foreclosure Overages List